A Guide to Understanding Virginia Supplemental Needs Trusts (Special Needs Trusts)

I. Introduction

Planning for the financial future of a loved one with disabilities can feel overwhelming. Families often grapple with questions about how to protect government benefits like Medicaid and Supplemental Security Income (SSI) while also ensuring their loved one’s needs are met. Special Needs Trusts (SNTs) offer a powerful solution.

A Special Needs Trust is a legal tool that allows families to set aside resources for a loved one with disabilities without jeopardizing their eligibility for essential government benefits. These trusts provide a way to enhance the quality of life for beneficiaries by covering costs that government programs do not, such as specialized care, education, and recreational activities. For families in the Central Shenandoah Valley, including Staunton, Lexington, Waynesboro, and surrounding areas, understanding how these trusts work and how they fit into your overall planning strategy is key to securing your loved one’s future.

In this guide, we’ll walk through the basics of Special Needs Trusts, the different types available, the benefits they offer, and answers to common questions. Whether you’re planning ahead or responding to a recent life change, this information will help you make informed decisions and take the next steps with confidence.

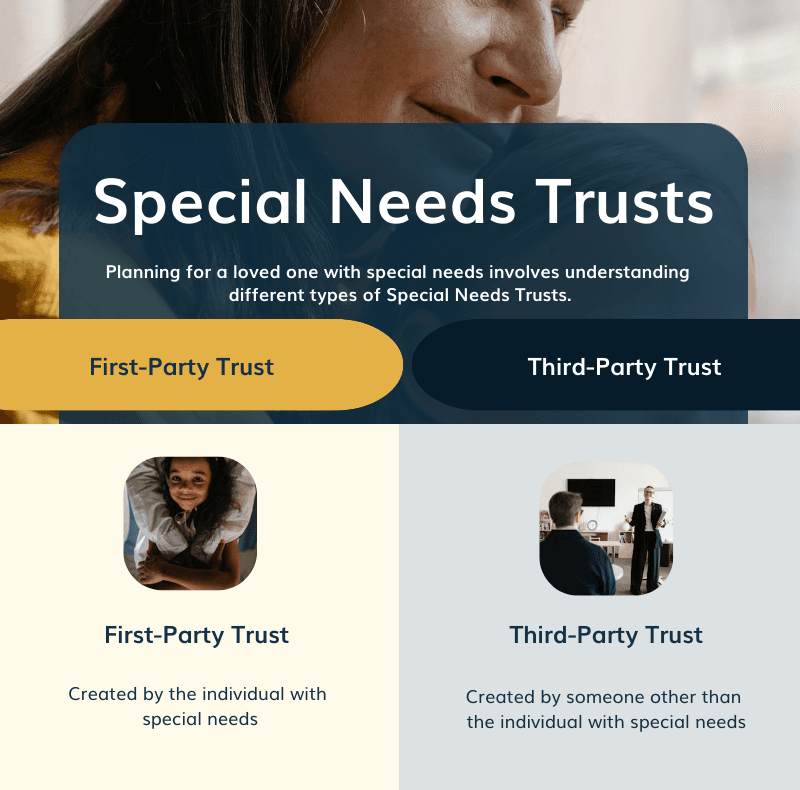

II. Types of Special Needs Trusts

When planning for your loved one’s future, it’s important to understand the different types of Special Needs Trusts available. Each type serves a unique purpose, depending on the source of the funds and the specific needs of your family. Below are the three main types of Special Needs Trusts:

1. First-Party Trusts: Using Your Loved One’s Own Assets

- A first-party trust is funded with assets that belong to the individual with disabilities. Common sources include inheritances, personal injury settlements, or savings.

- These trusts are often established when the individual with disabilities receives a large sum of money and needs to protect their eligibility for means-tested government benefits like Medicaid and SSI.

- Key Features:

- The trust must be established by the individual, a parent, grandparent, legal guardian, or a court.

- Federal law mandates a Medicaid payback provision. Upon the beneficiary’s death, any remaining funds are used to reimburse Medicaid for benefits provided.

- When to Consider:

- Your loved one has received a significant inheritance or legal settlement.

- They have assets that exceed the resource limits for benefits eligibility.

2. Third-Party Trusts: Planning Ahead with Family Resources

- A third-party trust is funded with assets that belong to someone other than the individual with disabilities, such as parents, grandparents, or other family members.

- These trusts are commonly created as part of a family’s estate plan to provide for the future needs of a loved one with disabilities without jeopardizing government benefits.

- Key Features:

- The trust can be funded during the lifetime of the grantor or upon their death through a will or living trust.

- No Medicaid payback provision is required, meaning remaining funds can be distributed to other beneficiaries.

- When to Consider:

- You’re planning for your child’s long-term financial needs.

- You want to ensure that unused funds can benefit other family members.

3. Pooled Trusts: A Solution for Modest Estates

- Pooled trusts are managed by nonprofit organizations that pool the assets of multiple beneficiaries while maintaining separate sub-accounts for each participant.

- This option is particularly beneficial for individuals or families with smaller estates, as it offers professional trust management at a lower cost compared to creating an individual trust.

- Key Features:

- Pooled trusts can be funded with either the beneficiary’s own assets or third-party contributions.

- They typically include a Medicaid payback provision for remaining funds.

- Local Resource: The ARC of the Piedmont offers a pooled trust option for families in the Central Shenandoah Valley.

- When to Consider:

- The total assets to fund the trust are modest and don’t justify the costs of creating a standalone trust.

- You prefer the convenience and expertise of professional management provided by a nonprofit.

Understanding these types of trusts and how they align with your family’s circumstances is an essential first step in the planning process. Each type of trust has its own requirements, benefits, and limitations, so consulting an experienced attorney is crucial to making the right choice for your loved one’s future.

III. Key Benefits for Your Family

Special Needs Trusts offer numerous advantages for families planning for the long-term well-being of a loved one with disabilities. Here are the key benefits:

1. Preserving Essential Government Benefits

- Many government assistance programs, such as Medicaid and Supplemental Security Income (SSI), have strict income and asset limits. Without proper planning, a loved one’s eligibility for these vital programs could be at risk.

- By holding assets in a Special Needs Trust, families can provide financial support for their loved ones without those assets being counted against government benefit thresholds.

2. Enhancing Quality of Life Beyond Basic Needs

- Special Needs Trusts allow funds to be used for a wide range of expenses that improve the beneficiary’s quality of life, such as:

- Specialized medical care or therapies not covered by Medicaid.

- Educational opportunities and training programs.

- Transportation, including adaptive vehicles.

- Recreational activities and hobbies that bring joy and enrichment.

- Assistive technology and home modifications to enhance independence.

- These trusts ensure that a loved one can access resources for a fuller, more enjoyable life.

3. Providing Peace of Mind for the Future

- For many families, the uncertainty of what will happen after they are no longer able to provide care is a significant concern. Special Needs Trusts help alleviate these worries by creating a clear plan for:

- Managing and distributing assets responsibly.

- Ensuring continuity of care and financial stability for the beneficiary.

- Knowing that a trusted individual or professional will oversee the trust provides reassurance and security for both the family and the individual with disabilities.

By offering a way to balance financial support with benefit protection, Special Needs Trusts serve as a cornerstone of long-term planning for families in Staunton, Lexington, Waynesboro, and the wider Central Shenandoah Valley region. With careful planning, these trusts ensure that your loved one’s needs are met both now and in the future.

IV. Common Questions from Virginia Families

1. “Won’t the government take care of my child?”

- While government programs like Medicaid and SSI provide essential support, they are designed to cover basic needs, such as healthcare and housing. They do not provide for many other aspects of life that contribute to overall well-being, such as recreational activities, specialized therapies, or advanced education. A Special Needs Trust bridges this gap by covering those additional expenses that enhance quality of life.

2. “Can I set up a trust myself?”

- It is possible to create a trust without legal assistance, but doing so comes with significant risks. Improperly drafted trusts can disqualify the beneficiary from receiving government benefits or fail to meet legal requirements. Working with an experienced attorney ensures the trust is structured correctly and tailored to your family’s unique needs.

3. “What can trust funds be used for?”

- Trust funds can be used for a wide variety of expenses, as long as they do not directly provide cash to the beneficiary or cover basic needs that government benefits are intended to fund. Examples include:

- Medical and dental care not covered by Medicaid.

- Educational expenses and tutoring.

- Vacations and entertainment.

- Personal care items and clothing.

- Transportation and adaptive equipment.

4. “Who should serve as trustee?”

- Selecting the right trustee is one of the most critical decisions when setting up a Special Needs Trust. Trustees are responsible for managing trust assets, making distributions, and ensuring compliance with government regulations. Options include:

- A trusted family member or friend.

- A professional trustee, such as a bank or trust company.

- A nonprofit organization that manages pooled trusts.

- It is essential to choose someone who is knowledgeable, trustworthy, and capable of navigating the complexities of trust administration.

V. Real-Life Examples

1. Receiving an Inheritance

- A family member wants to leave money to their niece, who has a disability and receives SSI and Medicaid. To ensure these benefits are not jeopardized, the funds are placed into a third-party Special Needs Trust. The trustee uses the funds to pay for items like tutoring, a new computer, and recreational activities, enhancing her quality of life without impacting her benefits.

2. Protecting Settlement Proceeds

- A young man with a disability receives a settlement from a personal injury case. His family establishes a first-party Special Needs Trust to protect the settlement funds. The trust allows him to purchase an adaptive vehicle, cover specialized therapies, and travel for medical consultations, all while maintaining his eligibility for Medicaid.

3. Planning for Lifetime Care

- Parents of a child with significant disabilities establish a third-party Special Needs Trust as part of their estate plan. The trust ensures their child’s long-term needs are met, including educational opportunities and daily living support, after the parents are no longer able to provide care themselves.

VI. Why Timing Matters

Timing plays a critical role in establishing and maintaining a Special Needs Trust. Life events and planning opportunities can impact your loved one’s financial security and benefit eligibility. Here’s why timing is so important:

1. Key Life Events That Trigger the Need for a Trust

- Receiving a Settlement or Inheritance: Without a trust in place, these funds could disqualify your loved one from receiving government benefits.

- Turning 18: When a child with disabilities becomes an adult, their eligibility for certain programs may change. Establishing a trust beforehand can provide a seamless transition.

- Marriage, Divorce, or Death in the Family: Major life events may alter your loved one’s financial needs or eligibility for benefits, making it essential to update or establish a trust.

2. Planning Opportunities You Shouldn’t Miss

- Estate Planning: Incorporating a Special Needs Trust into your will or living trust ensures that any assets intended for your loved one are properly protected.

- Proactive Trust Funding: Funding a trust early allows assets to grow over time and provides immediate financial security for your loved one.

3. When to Review and Update Existing Trusts

- Changes in laws, regulations, or your family’s circumstances may require updates to the trust. Regular reviews with an attorney can ensure the trust remains effective and compliant.

Worried About the Financial Future of Your Loved One?

We can help you get peace of mind knowing the future is secure.

Planning for the future of a loved one with disabilities is an important and compassionate step. At Prior Law, we’re here to help you every step of the way. Call or book an appointment today to speak with us about getting a supplemental needs trust.